[ad_1]

Market sentiment drives the cryptocurrency market tendencies. There are two easy assumptions – most traders get grasping when the market is bullish, whereas worry ends in bearish tendencies, making them panic promote when the worth of crypto property (primarily Bitcoin’s value) drops sharply.

The Crypto Worry and Greed Index intention to take human psychology under consideration and analyze the crypto market behaviour to assist crypto traders forecast the course of the value motion and make knowledgeable buying and selling selections by placing the final market sentiments into perspective.

If folks behave the identical manner in sure contexts, is it attainable to revenue by being “fearful when others are grasping and grasping when others are fearful,” as quoted by world-renowned investor Warren Buffet?

The Worry and Greed Index was created to reply this query by offering insights into the final sentiments of the crypto markets.

Let’s get proper to it!

What Is Crypto Worry and Greed Index

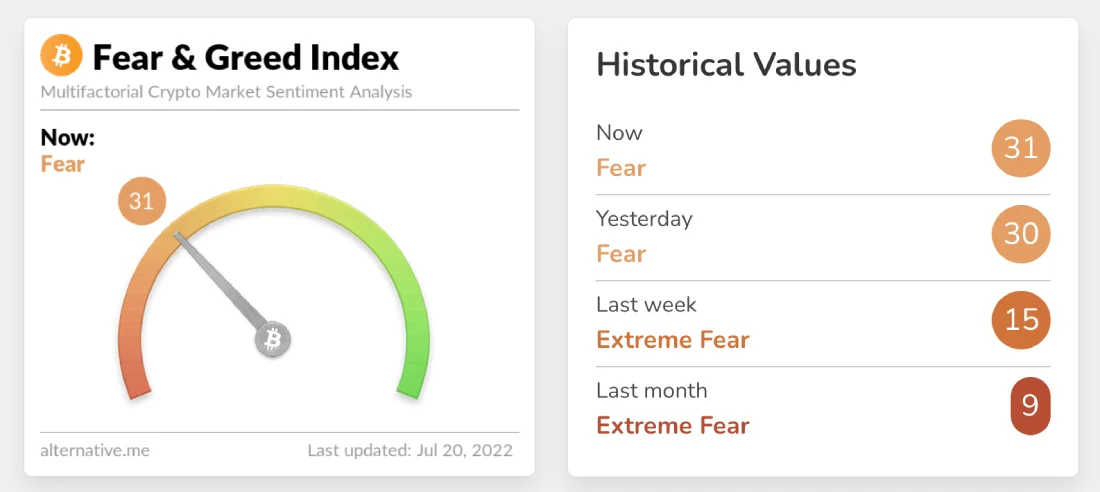

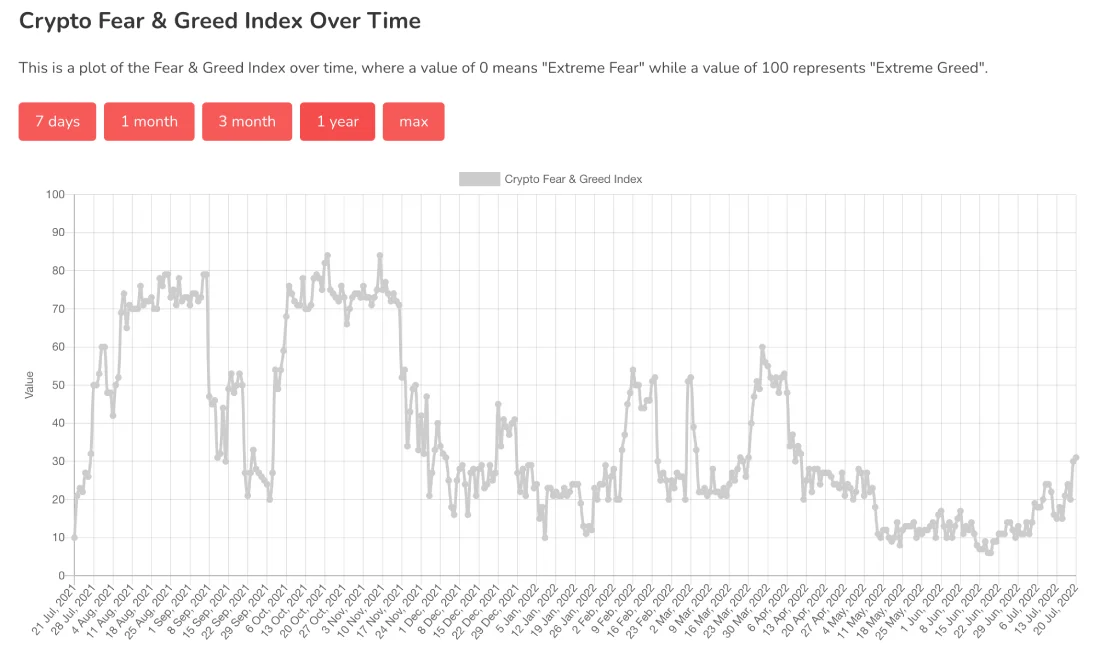

The Worry and Greed Index was created by CNNMoney for the US Inventory Market as an analytical device to guage market sentiment. It generates a single worth between 1 and 100. If the index lies between 0 and 24, excessive worry rises, and traders expertise extreme worry and promote their holdings in an irrational response. A normal rule of thumb is that when the index worth is at 1, costs are low, which usually correlates to a shopping for alternative earlier than excessive costs crash. Something above 24 and below 50 represents worry, and the worth of fifty means neutrality available in the market.

When the worth of the index lies between 51 and 74, it’s a sign of a grasping market; nevertheless, if the worth is 75 or above, it means merchants are experiencing excessive greed (i.e., shopping for extra property), pointing to market greed prevailing. Excessive greed available in the market may very well be interpreted as an finish of the predominant bullish market; due to this fact, promoting your digital property at that time is mostly a good suggestion.

This technical indicator is usually a worthwhile device for traders, and the information high quality is essential to acquiring a significant end result.

Why Do We Want Crypto Worry and Greed Index

So why measure Worry and Greed?

The crypto market behaviour may be very emotional, and plenty of crypto traders make funding selections based mostly on feelings. Folks are inclined to get grasping when the market is rising, which ends up in FOMO (Worry of lacking out) and merchants shopping for crypto for an all-time excessive value. For instance, folks FOMO-ed into Dogecoin when its value was at an all-time excessive, as you’ll be able to see on this chart on Dogecoin Worth.

Equally, merchants usually promote their cash within the irrational response of seeing crimson numbers.

Due to this fact, the crypto Worry and Greed Index, analyzing the present sentiment of crypto markets, is a wonderful device for merchants as a result of it tells them to accumulate extra crypto throughout a fearful market and promote their holdings in a euphoric market.

How Does Crypto Worry and Greed Index Work

The Worry and Greed Index is set by a number of elements, together with the volatility of the crypto market, social media, market quantity, and Bitcoin’s dominance.

It analyzes the present market circumstances and sentiments of Bitcoin and different massive cryptocurrencies and places it in a easy meter starting from 0 to 100. On prime of that, the Worry and Greed Index is colour coded, i.e., when it’s near zero, the colour is “Pink,” and when it’s nearer to 100, the colour is “Inexperienced.”

That is how the Worry & Greed Index is measured:

- 0–24 = Excessive Worry

- 25–49 = Worry

- 50–74 = Greed

- 75–100 = Excessive Greed

Information sources are assembled from a number of sources, and the index chart is refreshed each 8 hours from 00:00, 08:00, and 16:00 UTC.

How Is the Worry and Greed Index Calculated

The score of the Worry and Greed Index for the Bitcoin market consists of the next elements:

Volatility (25%)

The Worry and Greed Index considers the present Bitcoin value in comparison with the averages of the final 30 and 90 days. Uncommon and powerful volatility straight impacts the value and will be seen as an indication of uncertainty and excessive worry available in the market amongst traders.

Market Momentum and Buying and selling Quantity (25%)

Bitcoin’s present buying and selling quantity and market momentum are in comparison with the final 30 and 90-day common values after which put collectively. The market momentum can go in an upward or downward development, which will be additional confirmed by modifications in buying and selling quantity. Excessive each day shopping for volumes will be thought of a bullish or grasping market.

Social Media (15%)

It makes use of a textual content processing algorithm to guage the variety of Twitter tweets tagged below particular hashtags (primarily #Bitcoin) and the speed at which customers tweet utilizing that hashtag to investigate the temper precisely. A constant and strange rise in interplay is often an indication of a grown public curiosity within the coin and corresponds to grasping market habits.

The Index creators are at present experimenting with including a Reddit sentiment evaluation utilizing an analogous textual content processing algorithm.

Surveys (15%)

Surveys (at present paused) mix information from a big public polling platform of round 2000-3000 voters. Weekly crypto polls ask folks how they see the market to get an image of the market sentiment of crypto traders.

Bitcoin Dominance (10%)

Bitcoin dominance resembles the market cap share of your complete crypto market. Traditionally, it has been noticed that each time Bitcoin dominance rises, it’s attributable to a worry of altcoin investments and the attainable reallocation of it into Bitcoin since Bitcoin is more and more changing into the secure haven of crypto.

Google Tendencies (10%)

The Google Tendencies information for Bitcoin-related search queries are additionally analyzed and regarded, with extra folks trying to find “Bitcoin value manipulation,” signifying excessive worry available in the market.

Conclusion

You need to use all of the assets and instruments out there for profitable crypto investing. The crypto Worry and Greed Index is a metric designed to measure the dominant market sentiment. Together with technical evaluation and basic evaluation, it could actually make it easier to make well-informed funding selections.

For additional info, test the CoinStats guides on “How you can Purchase Dogecoin,” “How you can Purchase Shiba Inu,” “Coinbase Alternate,” and “Coinbase Assessment.” Learn our CoinStats information, “What Is DeFi,” to realize a basic understanding of Decentralized Finance, and see our “Crypto Portfolio Trackers” to be taught extra about the perfect crypto portfolio trackers available in the market.

Funding Recommendation Disclaimer: The knowledge contained on this web site is supplied to you solely for informational functions and doesn’t represent a advice by CoinStats to purchase, promote, or maintain any securities, monetary product, or instrument talked about within the content material, nor does it represent funding recommendation, monetary recommendation, buying and selling recommendation, or some other kind of recommendation. Any use or reliance on our content material is solely at your personal threat and discretion.

Cryptocurrency is a extremely risky market, do your personal analysis, seek the advice of your monetary advisor, and solely make investments the cash you’ll be able to afford to lose. Efficiency is unpredictable, and the previous efficiency of Mobox isn’t any assure of its future efficiency.

[ad_2]

Source link